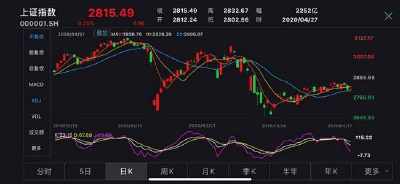

机器学习在股票价格预测中有着重要的应用。在这个机器学习项目中,我们将讨论预测股票收益。这是一项非常复杂的任务,而且是不确定的。我们将把这个项目分成两部分:

首先,我们将学习如何使用LSTM神经网络来预测股票价格。然后,我们将使用Plotly dash构建一个用于股票分析的仪表板。

股票价格预测项目

数据集

为了建立股价预测模型,我们将使用NSE TATA GLOBAL数据集。这是来自印度国家证券交易所塔塔全球饮料有限公司的塔塔饮料数据集:塔塔全球数据集为了开发一个用于股票分析的仪表板,我们将使用另一个包含多只股票的股票数据集,例如苹果、微软、脸书:Stocksdataset源代码

。请留言。

使用LSTM预测股价

1.导入:导入熊猫作为PD import numpy as NP import matplotlib . py plot as PLT % matplotlib inlinefrom matplotlib . py lab import rcParamssrcparams[' fig . fig size ']=20,10 from keras . models import sequentialifrom keras . layers import LSTM,Dropout,Densefrom sklearn .预处理导入MinMaxScalerimport熊猫作为PD import matplotlib . py plot as % matplot lib inlinefrom matplot Li b . py ab导入rcparams

/pre>import pandas as pdimport numpy as npimport matplotlib.pyplot as plt%matplotlib inlinefrom matplotlib.pylab import rcParamsrcParams['figure.figsize']=20,10from keras.models import Sequentialfrom keras.layers import LSTM,Dropout,Densefrom sklearn.preprocessing import MinMaxScaler

2.读取数据集:

df=pd.read_csv("NSE-TATA.csv")df.head()

3.从数据框分析收盘价:

df["Date"]=pd.to_datetime(df.Date,format="%Y-%m-%d")df.index=df['Date']plt.figure(figsize=(16,8))plt.plot(df["Close"],label='Close Price history')

4.按日期时间对数据集进行排序,然后过滤“日期”和“关闭”列:

data=df.sort_index(ascending=True,axis=0)new_dataset=pd.DataFrame(index=range(0,len(df)),columns=['Date','Close'])for i in range(0,len(data)): new_dataset["Date"][i]=data['Date'][i] new_dataset["Close"][i]=data["Close"][i]

5.标准化新的过滤数据集:

scaler=MinMaxScaler(feature_range=(0,1))final_dataset=new_dataset.valuestrain_data=final_dataset[0:987,:]valid_data=final_dataset[987:,:]new_dataset.index=new_dataset.Datenew_dataset.drop("Date",axis=1,inplace=True)scaler=MinMaxScaler(feature_range=(0,1))scaled_data=scaler.fit_transform(final_dataset)x_train_data,y_train_data=[],[]for i in range(60,len(train_data)): x_train_data.append(scaled_data[i-60:i,0]) y_train_data.append(scaled_data[i,0]) x_train_data,y_train_data=np.array(x_train_data),np.array(y_train_data)x_train_data=np.reshape(x_train_data,(x_train_data.shape[0],x_train_data.shape[1],1))

6.建立和训练LSTM模型:

lstm_model=Sequential()lstm_model.add(LSTM(units=50,return_sequences=True,input_shape=(x_train_data.shape[1],1)))lstm_model.add(LSTM(units=50))lstm_model.add(Dense(1))inputs_data=new_dataset[len(new_dataset)-len(valid_data)-60:].valuesinputs_data=inputs_data.reshape(-1,1)inputs_data=scaler.transform(inputs_data)lstm_model.compile(loss='mean_squared_error',optimizer='adam')lstm_model.fit(x_train_data,y_train_data,epochs=1,batch_size=1,verbose=2)

7.抽取数据集样本,以使用LSTM模型进行股票价格预测:

X_test=[]for i in range(60,inputs_data.shape[0]): X_test.append(inputs_data[i-60:i,0])X_test=np.array(X_test)X_test=np.reshape(X_test,(X_test.shape[0],X_test.shape[1],1))predicted_closing_price=lstm_model.predict(X_test)predicted_closing_price=scaler.inverse_transform(predicted_closing_price)

8.保存LSTM模型:

lstm_model.save("saved_model.h5")

9.用实际股价可视化预测的股价:

train_data=new_dataset[:987]valid_data=new_dataset[987:]valid_data['Predictions']=predicted_closing_priceplt.plot(train_data["Close"])plt.plot(valid_data[['Close',"Predictions"]])

您可以观察到LSTM预测的股价几乎与实际股价相似。

使用Plotly dash构建仪表板

在本节中,我们将构建一个仪表板来分析股票。Dash是一个python框架,提供了flask和react.js的抽象,以构建分析型Web应用程序。

在继续之前,您需要安装dash。在终端中运行以下命令。

pip3 install dashpip3 install dash-html-componentspip3 install dash-core-components

现在制作一个新的python文件stock_app.py并粘贴以下脚本:

import dashimport dash_core_components as dccimport dash_html_components as htmlimport pandas as pdimport plotly.graph_objs as gofrom dash.dependencies import Input, Outputfrom keras.models import load_modelfrom sklearn.preprocessing import MinMaxScalerimport numpy as npapp = dash.Dash()server = app.serverscaler=MinMaxScaler(feature_range=(0,1))df_nse = pd.read_csv("./NSE-TATA.csv")df_nse["Date"]=pd.to_datetime(df_nse.Date,format="%Y-%m-%d")df_nse.index=df_nse['Date']data=df_nse.sort_index(ascending=True,axis=0)new_data=pd.DataFrame(index=range(0,len(df_nse)),columns=['Date','Close'])for i in range(0,len(data)): new_data["Date"][i]=data['Date'][i] new_data["Close"][i]=data["Close"][i]new_data.index=new_data.Datenew_data.drop("Date",axis=1,inplace=True)dataset=new_data.valuestrain=dataset[0:987,:]valid=dataset[987:,:]scaler=MinMaxScaler(feature_range=(0,1))scaled_data=scaler.fit_transform(dataset)x_train,y_train=[],[]for i in range(60,len(train)): x_train.append(scaled_data[i-60:i,0]) y_train.append(scaled_data[i,0]) x_train,y_train=np.array(x_train),np.array(y_train)x_train=np.reshape(x_train,(x_train.shape[0],x_train.shape[1],1))model=load_model("saved_model.h5")inputs=new_data[len(new_data)-len(valid)-60:].valuesinputs=inputs.reshape(-1,1)inputs=scaler.transform(inputs)X_test=[]for i in range(60,inputs.shape[0]): X_test.append(inputs[i-60:i,0])X_test=np.array(X_test)X_test=np.reshape(X_test,(X_test.shape[0],X_test.shape[1],1))closing_price=model.predict(X_test)closing_price=scaler.inverse_transform(closing_price)train=new_data[:987]valid=new_data[987:]valid['Predictions']=closing_pricedf= pd.read_csv("./stock_data.csv")app.layout = html.Div([ html.H1("Stock Price Analysis Dashboard", style={"textAlign": "center"}), dcc.Tabs(id="tabs", children=[ dcc.Tab(label='NSE-TATAGLOBAL Stock Data',children=[ html.Div([ html.H2("Actual closing price",style={"textAlign": "center"}), dcc.Graph( id="Actual Data", figure={ "data":[ go.Scatter( x=train.index, y=valid["Close"], mode='markers' ) ], "layout":go.Layout( title='scatter plot', xaxis={'title':'Date'}, yaxis={'title':'Closing Rate'} ) } ), html.H2("LSTM Predicted closing price",style={"textAlign": "center"}), dcc.Graph( id="Predicted Data", figure={ "data":[ go.Scatter( x=valid.index, y=valid["Predictions"], mode='markers' ) ], "layout":go.Layout( title='scatter plot', xaxis={'title':'Date'}, yaxis={'title':'Closing Rate'} ) } ) ]) ]), dcc.Tab(label='Facebook Stock Data', children=[ html.Div([ html.H1("Facebook Stocks High vs Lows", style={'textAlign': 'center'}), dcc.Dropdown(id='my-dropdown', options=[{'label': 'Tesla', 'value': 'TSLA'}, {'label': 'Apple','value': 'AAPL'}, {'label': 'Facebook', 'value': 'FB'}, {'label': 'Microsoft','value': 'MSFT'}], multi=True,value=['FB'], style={"display": "block", "margin-left": "auto", "margin-right": "auto", "width": "60%"}), dcc.Graph(id='highlow'), html.H1("Facebook Market Volume", style={'textAlign': 'center'}), dcc.Dropdown(id='my-dropdown2', options=[{'label': 'Tesla', 'value': 'TSLA'}, {'label': 'Apple','value': 'AAPL'}, {'label': 'Facebook', 'value': 'FB'}, {'label': 'Microsoft','value': 'MSFT'}], multi=True,value=['FB'], style={"display": "block", "margin-left": "auto", "margin-right": "auto", "width": "60%"}), dcc.Graph(id='volume') ], className="container"), ]) ])])@app.callback(Output('highlow', 'figure'), [Input('my-dropdown', 'value')])def update_graph(selected_dropdown): dropdown = {"TSLA": "Tesla","AAPL": "Apple","FB": "Facebook","MSFT": "Microsoft",} trace1 = [] trace2 = [] for stock in selected_dropdown: trace1.append( go.Scatter(x=df[df["Stock"] == stock]["Date"], y=df[df["Stock"] == stock]["High"], mode='lines', opacity=0.7, name=f'High {dropdown[stock]}',textposition='bottom center')) trace2.append( go.Scatter(x=df[df["Stock"] == stock]["Date"], y=df[df["Stock"] == stock]["Low"], mode='lines', opacity=0.6, name=f'Low {dropdown[stock]}',textposition='bottom center')) traces = [trace1, trace2] data = [val for sublist in traces for val in sublist] figure = {'data': data, 'layout': go.Layout(colorway=["#5E0DAC", '#FF4F00', '#375CB1', '#FF7400', '#FFF400', '#FF0056'], height=600, title=f"High and Low Prices for {', '.join(str(dropdown[i]) for i in selected_dropdown)} Over Time", xaxis={"title":"Date", 'rangeselector': {'buttons': list([{'count': 1, 'label': '1M', 'step': 'month', 'stepmode': 'backward'}, {'count': 6, 'label': '6M', 'step': 'month', 'stepmode': 'backward'}, {'step': 'all'}])}, 'rangeslider': {'visible': True}, 'type': 'date'}, yaxis={"title":"Price (USD)"})} return figure@app.callback(Output('volume', 'figure'), [Input('my-dropdown2', 'value')])def update_graph(selected_dropdown_value): dropdown = {"TSLA": "Tesla","AAPL": "Apple","FB": "Facebook","MSFT": "Microsoft",} trace1 = [] for stock in selected_dropdown_value: trace1.append( go.Scatter(x=df[df["Stock"] == stock]["Date"], y=df[df["Stock"] == stock]["Volume"], mode='lines', opacity=0.7, name=f'Volume {dropdown[stock]}', textposition='bottom center')) traces = [trace1] data = [val for sublist in traces for val in sublist] figure = {'data': data, 'layout': go.Layout(colorway=["#5E0DAC", '#FF4F00', '#375CB1', '#FF7400', '#FFF400', '#FF0056'], height=600, title=f"Market Volume for {', '.join(str(dropdown[i]) for i in selected_dropdown_value)} Over Time", xaxis={"title":"Date", 'rangeselector': {'buttons': list([{'count': 1, 'label': '1M', 'step': 'month', 'stepmode': 'backward'}, {'count': 6, 'label': '6M', 'step': 'month', 'stepmode': 'backward'}, {'step': 'all'}])}, 'rangeslider': {'visible': True}, 'type': 'date'}, yaxis={"title":"Transactions Volume"})} return figureif __name__=='__main__': app.run_server(debug=True)

现在运行此文件并在浏览器中打开应用程序:

python3 stock_app.py[object Object]

总结

股票价格预测是面向初学者的机器学习项目;在本教程中,我们学习了如何开发股票成本预测模型以及如何构建交互式仪表板进行库存分析。我们使用LSTM模型实施了股票市场预测。另外,用Plotly dashpython框架构建仪表板。